Egypt Gives Red Sea Land to Help Pay Off Debt and Boost Islamic Bonds

The Egyptian government has set aside a piece of coastal land on the Red Sea, about 41,000 feddans (174.4 square kilometers), to help lower the country’s public debt and support the issuing of Islamic bonds (sukuk), according to the official government publication.

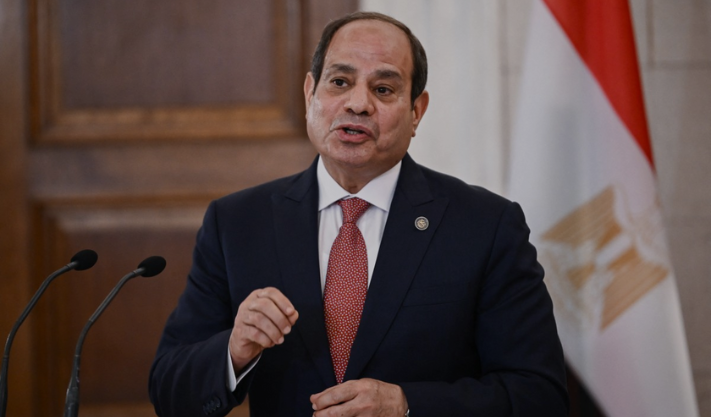

President Abdel Fattah El-Sisi approved the decision to give the land in the Ras Shokeir area to the Ministry of Finance. However, the military will still control parts of the land that are important for national security.

Egypt’s External Debt

In recent years, Egypt’s external debt has increased. This is mainly because the country spent a lot of money on big projects like the New Administrative Capital and other infrastructure developments. The government also used money to help support the value of the Egyptian pound. To manage its finances, Egypt agreed to an $8 billion loan from the International Monetary Fund (IMF) as part of a wider economic reform plan.

According to the Central Bank of Egypt, the external debt slightly fell to $155.09 billion by the end of December 2024, compared to $155.20 billion in September.

By the end of the year, the external debt made up about 42.9% of Egypt’s total economy (GDP).

In the second quarter of the 2024/2025 financial year, Egypt paid $13.4 billion to repay its debt. This included $1.86 billion in interest and $11.49 billion in the original loan amounts.

Ras Al Khaimah Project

Last year, Egypt made a major deal with the United Arab Emirates. It sold a 170-square-kilometer area on the northwestern Mediterranean coast to build a new city called Ras Al Khaimah. The deal, worth $35 billion, brought in much-needed foreign currency and helped reduce pressure on the Egyptian pound.

The city project was signed with ADQ, a large investment fund from Abu Dhabi. Total investments in the project are expected to reach about $110 billion by 2045.

Published: 12th June 2025

For more article like this please follow our social media Facebook, Linkedin & Instagram

Also Read:

TMG Launches Sharm Bay, Targets $2.4B & Luxury Tourism Boost

Jordan Launches Aqaba Blue Ventures at UN Ocean Conference

Helping Syria Grow: Business & Farming Driving Change